What dollar value does a development approval (DA) add to your property sale price? The common assumption is that a development approval will add a decent amount of value to the sale price of a property. That is, do all the groundwork and get all the approvals in place so the buyer can just start their development straight away. I researched to see what kind of evidence there is of this being the case and was disappointed with the amount of study completed in this area. So, I’ve done my own investigation utilising 65 properties of different scale/price/development potential to see if there is any direct correlation between the sale price and DA history.

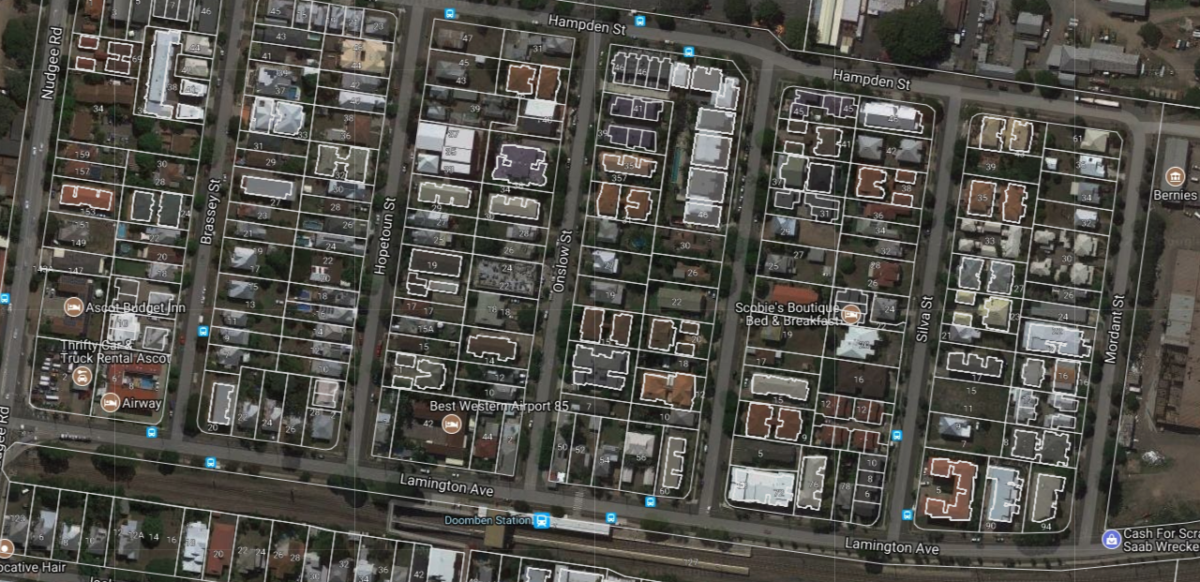

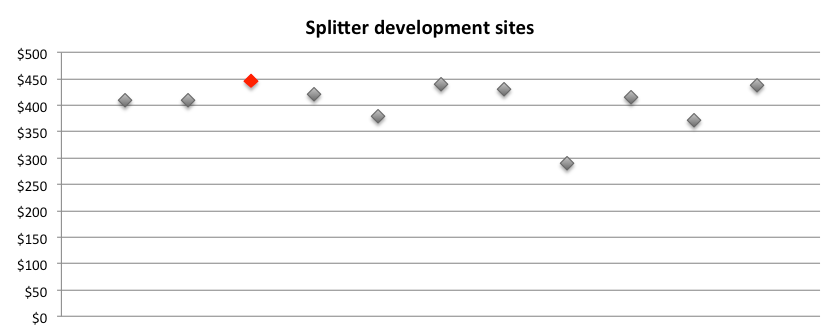

Using an unlimited PropertEASE subscription, I researched properties of the same size in the same area with the same development potential that were sold within the past 12 months. Firstly, I looked at typical splitter blocks. Some notes before we start, table legend: grey dots = sites without DA, red dots = sites with DA, sale price is in $100,000s.

A splitter block (1 into 2 subdivision) is typically an easy and quick way to make money but is there any point of gaining an approval prior to the sale of the property? We looked at 11 different sites in the same area with the same development potential…etc. and only one of the properties was sold with a DA on it. The highest sale price was $446k and the lowest being $291k with the average sale price being $404k. In this particular area, the only property with DA sold for $42k more than the average sale price of the area.

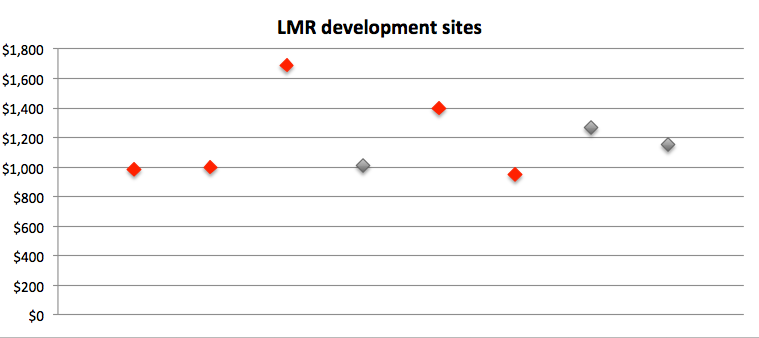

Now onto an LMR site (i.e. a townhouse site). Although there is a bit more work involved with the development of an LMR site, it is commonly the next step for a developer up from a ‘splitter’. After investigating 8 properties, 5 of them have DAs prior to sale. The average sale price of a property with a DA in place was $1.205m with properties without a DA being $1.143m. As such, on average, properties with a DA when it was listed for sale sold for $62k more than one without.

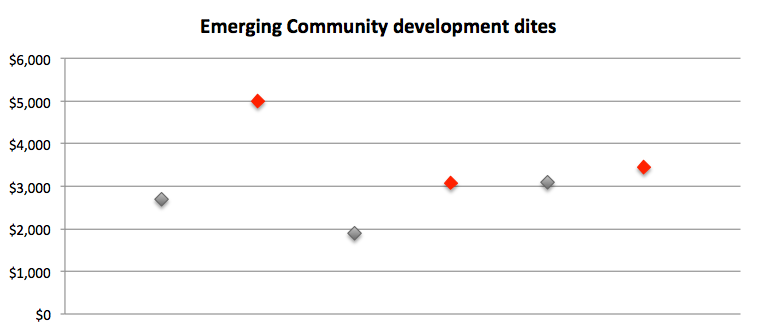

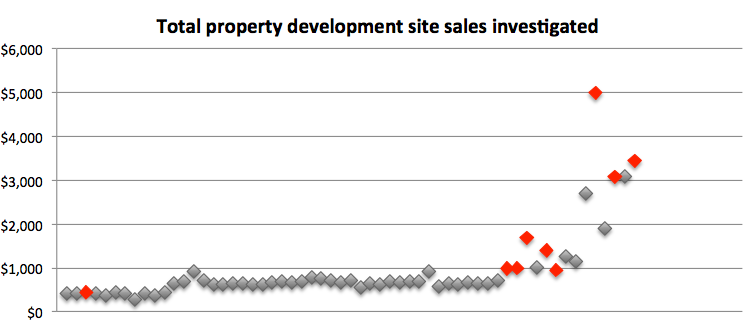

There does appear to be a common trend starting to develop amongst small-medium scale development sites but what about the higher end of town? We looked at 6 sites within an ‘Emerging Community Zone’ all around 1ha in size. The average sale price was $3.204m with the average sale price of a property without DA being $2.566m and with a DA $3.842m. It does appear that there is a clear value add having a DA on your property but removing the $5m anomaly sale (refer to table below), the average site sale price with a DA was $3.264m, which is still $698k more than the average sale price without a DA in place.

So, what can we take away from this investigation? From our small sample size of 65 properties, it looks like there is a clear ‘value-add’ to putting a DA in place for a potential development site with the bigger rewards for larger higher yield sites but a larger investigation would warrant more accurate results. I will note that the above statistics have not taken into account the actual costs of the development approval, which may vary quite significantly. I will look into those costs more closely in upcoming blog posts.

For your information, the full list of properties investigated below. Some notes/observations:

- All sites compared in the above investigations were the same size and were all free of any constrictive overlays;

- A larger amount of properties were investigated but it was found that a large number of Splitter and LMR sites in the same area did not have any DA history on them so were excluded from the study;

- The Splitter and LMR studies only included blocks the same size in the same area (i.e. some of the total sample size were removed);

- All properties were located within the Brisbane City Council area;

- Low-Med size development sites are unlikely to have an existing DA in place; and

- Higher end development sites are more likely to have an existing DA in place.

It is always best to get the professional opinion of a town planner and a local real estate agent before making any decisions.